Nc 4 nra allowance worksheet schedules schedule 1 estimated nc. Find the secton for your marital status and answer all the questions for that section and follow its directions.

The determination of the number of allowances on the nc 4ez or nc 4.

Nc 4 allowance worksheet. You should also refer to the multiple jobs table to determine the additional amount to be withheld on line 2 of form nc 4 see allowance worksheet. Your withholding will usually be most accurate when all allowances are claimed on the nc 4 filed for the higher paying job and zero allowances are claimed for the other. Child deduction amount a taxpayer who is allowed a federal child tax credit under section 24 of the internal revenue code is allowed a deduction for each dependent child unless adjusted gross income exceeds the threshold amount shown below.

This does take a more work to complete properly than the new nc 4 ez. Your withholding will usually be most accurate when all allowances are claimed on the nc 4 filed for the higher paying job and zero allowances are claimed for the other. Franchise tax corporate income tax and insurance premium tax rules and bulletins reflecting changes made in the 2017 regular session of the north carolina general assembly.

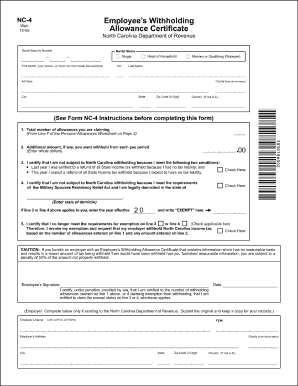

You should also refer to the multiple jobs table to determine the additional amount to be withheld on line 2 of form nc 4 see page 4. How to fill out the nc 4. 1total number of allowances you are claiming enter zero 0 or the number of allowances from page 2 line 11 of the nc 4 nra allowance worksheet additional amount to withhold from each pay period see chart on page 2 part ii line 12 2.

Your withholding will usually be most accurate when all allowances are claimed on the nc 4 filed for the higher paying job and zero allowances are claimed for the other. Instructions on completing new nc 4. Employee elected additional withholding enter whole dollars 30000.

Allowance worksheet part i. Allowance worksheet part ii line 4 federal adjustments health savings account moving expenses alimony paid ira deduction student loan. It may send you back with a number to enter on line 1 or send you to complete part ii of the allowance worksheet.

You should also refer to the multiple jobs table to determine the additional amount to be withheld on line 2 of form nc 4 see allowance worksheet. It will send you to the nc 4 allowance worksheet to determine the number to enter here. 2017 corporate income franchise and insurance tax rules and bulletins.

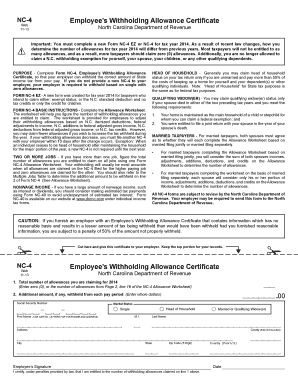

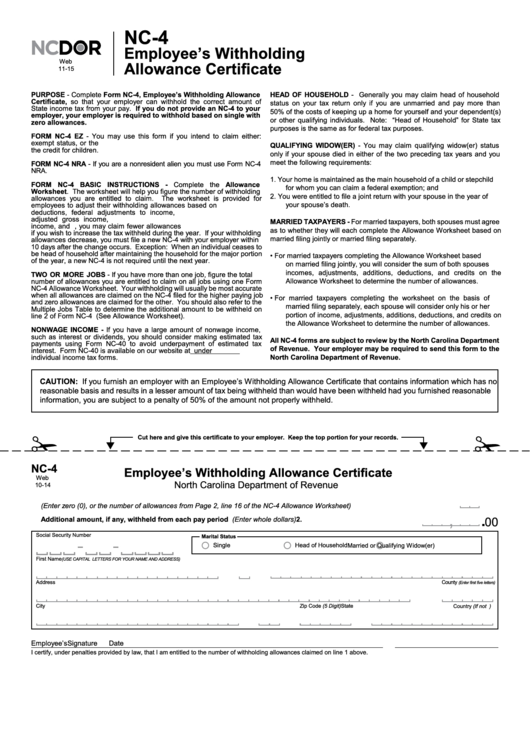

The nc 4 is designed for people that want to be more precise about their nc income tax. Form nc 4 employees withholding allowance certificate.

Fillable Online Nc 4 Employee S Withholding Allowance Certificate

Fillable Online Nc 4 Employee S Withholding Allowance Certificate  7 North Carolina Nc 4 Forms And Templates Free To Download In Pdf

7 North Carolina Nc 4 Forms And Templates Free To Download In Pdf  Nc 4 Withholding Tax Tax Deduction

Nc 4 Withholding Tax Tax Deduction  If You Answered No To All Of The Above Stop Here And Enter Zero 0 As

If You Answered No To All Of The Above Stop Here And Enter Zero 0 As  2009 Form Nc Dor Nc 4 Fill Online Printable Fillable Blank

2009 Form Nc Dor Nc 4 Fill Online Printable Fillable Blank

0 comments